Transaction

Moelis Australia Asset Management’s acquisition of Redcape Hotel Group Pty Ltd

READ MORENews

Moelis & Company Appoints Jugjeev Duggal as a Managing Director

Strengthens its M&A Capabilities in Clean Technology and Power, Utilities & Infrastructure Moelis & Company (NYSE: MC), a leading global independent investment bank, today announced that it has appointed Jugjeev…

Read MoreNews

Moelis Appoints Ankit Dalal as a Managing Director in its Capital Structure Advisory Group

…restructuring and liability management landscape. Thane Carlston and William Derrough, Global Co-Heads of Capital Structure Advisory at Moelis commented, “As the credit landscape continues to evolve, we are excited to…

Read MoreNews

Moelis Appoints Dr. Louise Mirrer as an Independent Member to its Board of Directors

…throughout her distinguished career. Ken Moelis, Chairman and CEO of Moelis & Company commented: “We are pleased to welcome Louise to our Board of Directors. Her impressive track record of…

Read MoreNews

Group develops proposed amended structure for ABCP MAV2 Notes to allow for redemptions

A group of institutional noteholders (the “Group”), for which Moelis & Company LLC (“Moelis”) is acting as primary financial advisor, has developed proposed amendments to the structure governing MAV2 notes…

Read MoreDubai Candidate Privacy Notice

In this notice, “Moelis”, “we”, “us” and “our” means Moelis & Company UK LLP, DIFC Branch. Moelis & Company UK LLP, DIFC Branch is registered at Dubai International Finance Centre…

[debug]

post_type: page

url: https://www.moelis.com/legal/dubai-candidate-data-privacy-notice/?hilite=sitepages%2Fwww.moelis.com

filters:

News

Moelis & Company Strengthens its Power & Utilities Expertise with Appointment of Philip Holder as a Managing Director

…Moelis commented, “We are pleased to deepen our capabilities and further enhance our commitment to our power and utility clients. Phil’s industry knowledge and unique perspective of the challenges that…

Read MoreNews

Moelis Enhances Credit Funds Coverage with Appointment of Robert Mendelson as a Managing Director

…at Moelis commented, “We are pleased to welcome Rob, whose buy-side experience and extensive relationships will bring a unique perspective to our global clients. As the credit landscape continues to…

Read MoreSenior Team

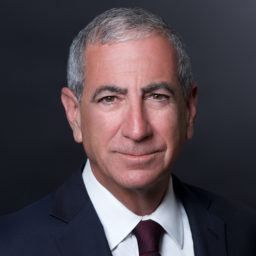

Ken Moelis

Founder, Chairman & Chief Executive Officer

New York

Ken Moelis is the Founder, Chairman of the Board of Directors and Chief Executive Officer of Moelis & Company. Ken has over 40 years of experience both as an investment banker and an executive, having served in various significant leadership roles where he has been responsible for the innovation and growth of franchises across the industry.

Prior to founding Moelis & Company, Ken was President of UBS Investment Bank and previously, Head of Corporate Finance at Donaldson, Lufkin & Jenrette. Ken began his investment banking career at Drexel Burnham Lambert.

Ken holds a B.S. in Economics and an M.B.A. from the Wharton School at the University of Pennsylvania. He is a member of the Business Council and the Business Roundtable, and currently serves on the Wharton Board of Advisors and the Ronald Reagan UCLA Medical Center Board of Advisors. He was formerly Board Chair and Director of the Tourette Association of America and served on the Board of Trustees at the University of Pennsylvania for 10 years.

Transaction

Tribune Media Company’s sale of its Digital and Data business operations, comprised of Gracenote video, music and sports, to the Nielsen Company

READ MORETransaction

Atrium Companies, Inc.’s Chapter 11 Reorganization consummated through sale of the company to Golden Gate Capital and Kenner & Company

READ MORENews

Moelis & Company Reports Third Quarter 2015 Financial Results; Quarterly Dividend of $0.30 Per Share

Read More